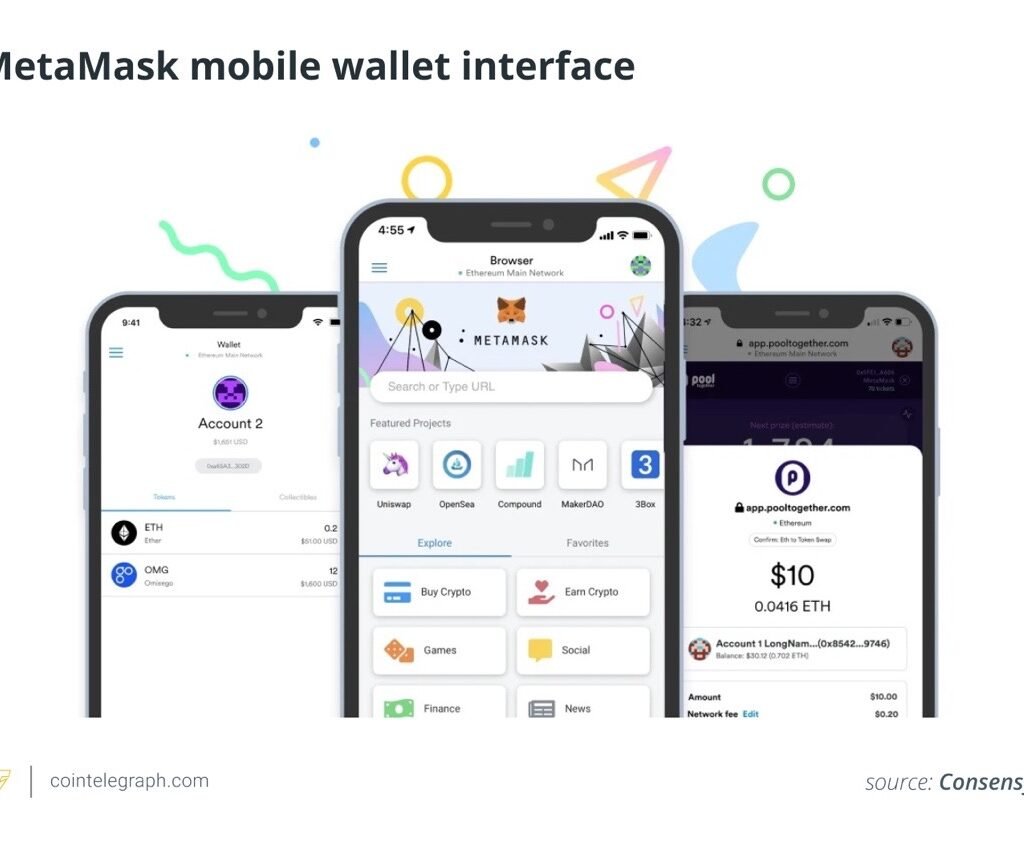

If you want to sell crypto through your MetaMask wallet, you need to know how to swap, bridge, and use currency off-ramps to turn your crypto into cash.

What to remember

- You can’t sell all tokens at once. If you get an airdropped or unusual token, it might not be liquid or could be a scam, so check before you try to cash it out.

- It may be necessary to swap and bridge. You might have to change tokens into ETH or stablecoins and connect them to the mainnet of Ethereum in order to sell them.

- Fiat off-ramps are built into MetaMask. You can use MetaMask Portfolio to sell ETH directly, but be ready for Know Your Customer (KYC) checks with third-party sources.

- There are non-KYC and peer-to-peer choices. You can trade on platforms like Bisq or LocalCoinSwap without an ID, but they are riskier and need more care.

When you use MetaMask, there are many ways that you could end up with a mix of different coins.

You might be a developer, copywriter, or artist in Web3, and your client paid you in the native token of their project.

You might also be a part of a Bitcoin mining pool and get prizes sent straight to your wallet every so often.

In decentralized finance (DeFi), you could be growing yield and getting a percentage yield (APY) on your locked assets. Another option is maybe the simplest: you did some jobs on SocialFi and got some community tokens as a reward through an airdrop.

No matter what, you have cryptocurrency in your MetaMask and want to exchange it for cash.

You can sell your cryptocurrency and get the money in your bank account or even in cash. This guide will show you all of your options, whether you want to use official Know Your Customer (KYC) methods or more private, non-KYC ones.

What you need to know before you sell MetaMask tokens

MetaMask has a few things you need to do before you can cash out your tokens. This is because “not all tokens are created equal.” It’s not always as easy as pressing the “sell” button, especially if you just got tokens through an airdrop or from a project that isn’t very well known.

1. The reason some airdropped tokens can’t be bought or sold

If you have a token in your wallet, that doesn’t mean you can sell it. To be honest, a lot of airdropped tokens aren’t even on platforms. In this case, there isn’t a place where you can sell them yet. There may be a price listed for the token, but you can’t actually get that value right now because there aren’t any buyers or sellers. Getting free coupons is great, but you might not use them for a while after getting them.

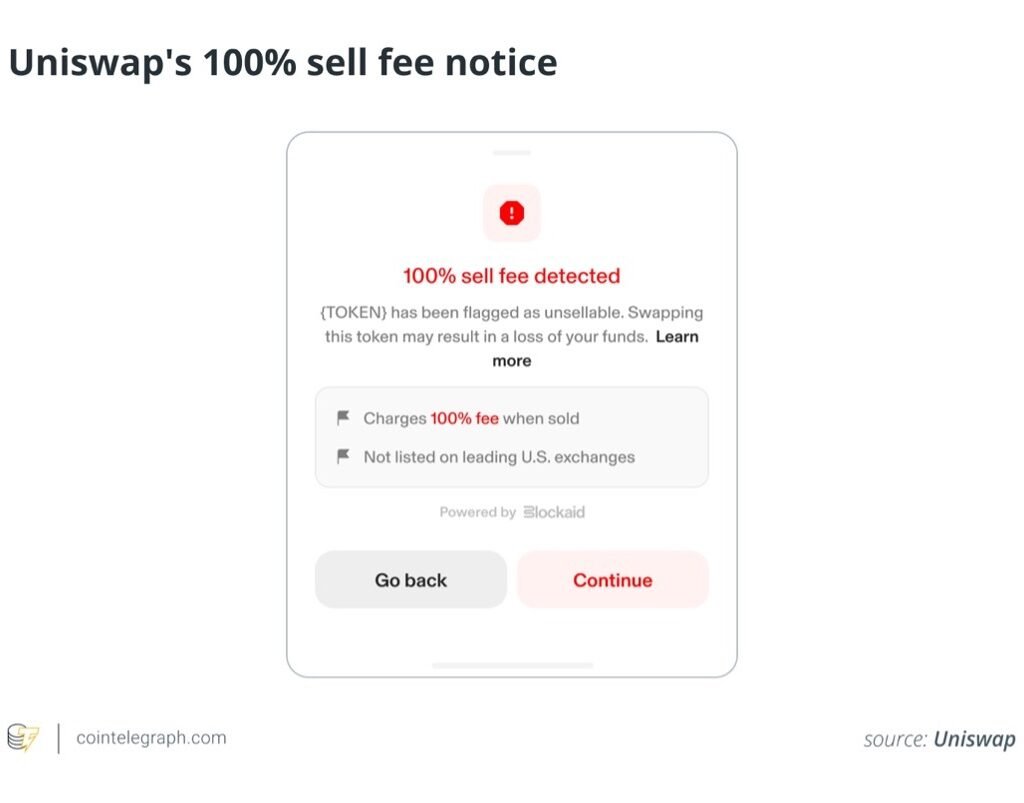

Did you know? If you see a “100% sell fee detected” warning on a token, it’s likely a scam. Scammers airdrop these tokens, hoping you’ll try to sell or interact with them. But when you do, the smart contract takes the full amount — leaving you with nothing. Worse, some link to fake decentralized applications (DApps) that ask you to “claim” or “unlock” the tokens. Connecting your wallet or signing a transaction there can let scammers drain your real assets.

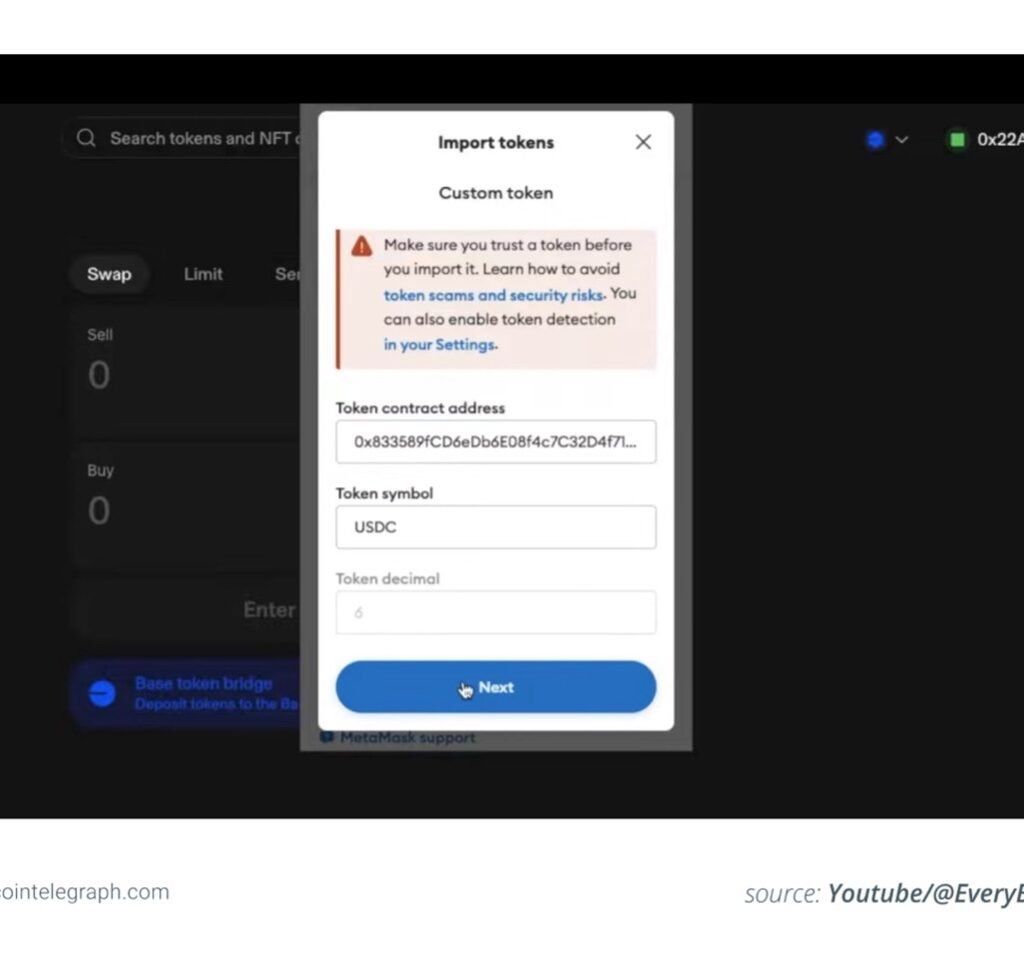

2. Adding coins that you don’t have to your wallet

Tokens will sometimes be sent to you that don’t even show up in MetaMask at first. That just means MetaMask doesn’t see them by default, not that they aren’t there. You will have to add them by hand by getting the token’s contract address (which you can usually find on the project’s website or Etherscan) and adding it to your wallet. After you do that, your balance will be correct.

Also, if you want to receive an asset other than Ether (ETH), you can use the “Import Tokens” option to add the missing tokens by hand so they show up in the list of assets.

3. Getting ready to bridge or swap

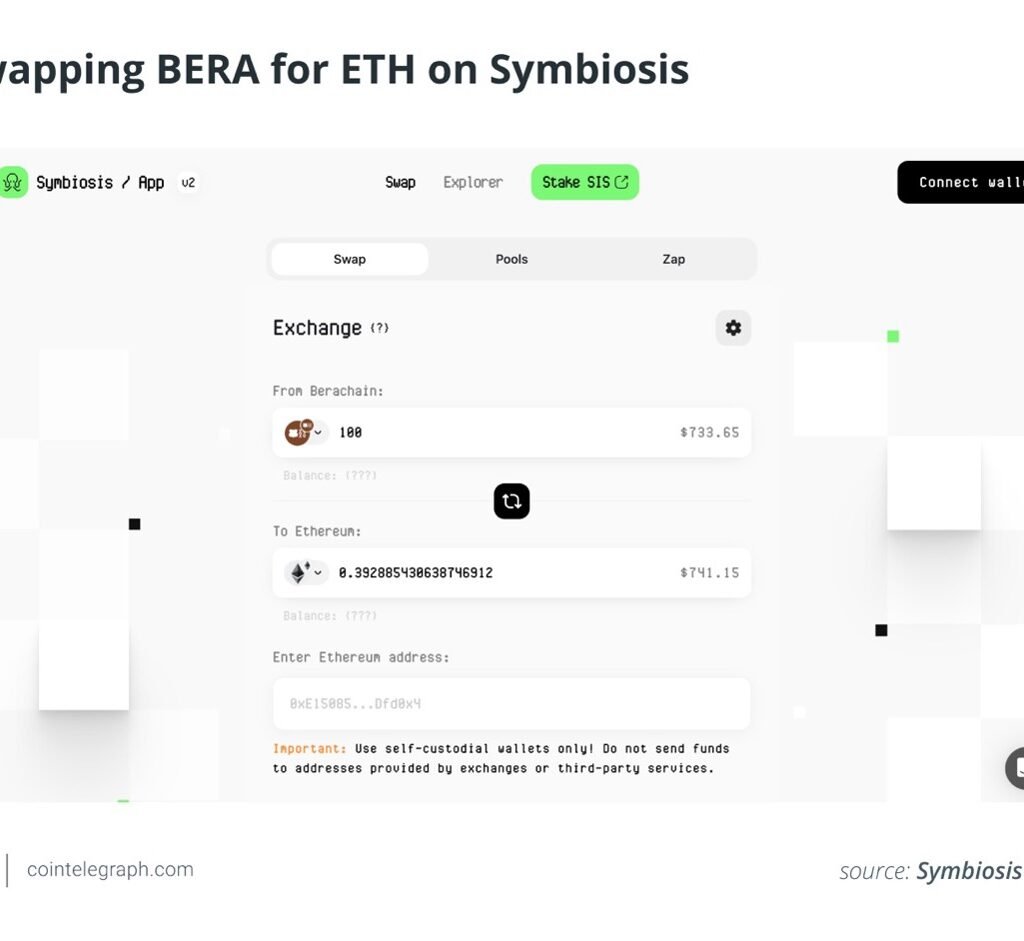

It’s not always possible to sell your tokens for cash right away, even if they can be seen in MetaMask and have value. If you want to trade a lot of smaller or younger tokens for dollars or euros, you won’t be able to do that directly.

To get around this, you’ll usually need to trade them in for something more flexible, like ETH or a stablecoin like USDC, which can be exchanged for hard cash.

Your tokens may also be on a different blockchain, such as Arbitrum, BNB Chain, or Polygon. However, most fiat withdrawal choices only work with Ethereum mainnet. If so, you’ll have to connect your tokens to Ethereum first before you can sell them.

When you use tools that combine these two steps into one flow, you can handle both of them at the same time. One example is Symbiosis.finance, which lets you trade a token on one chain for a more widely used token on Ethereum. This can all be done in one transaction. This can save you time and make it less likely that you’ll make a mistake when switching between tools.

How to use MetaMask to sell cryptocurrency

The easiest way to sell crypto that you have stored on MetaMask is to use the app itself. Do these things:

- Go to your MetaMask extension or app and click on the “Buy & Sell” button to open your account. This will take you to the MetaMask Portfolio site, where you can start selling your goods and keep track of them all.

- Start the process of selling: At the top of the page, click “Move crypto.” Then, from the dropdown menu, choose “Sell.”

- Pick your country and currency: MetaMask will ask you what country you live in and what cash currency you want to use. This step makes sure that you are shown the correct list of providers and payment choices that are available in your area.

- Type in the sale amount: Choose Ether and type in the amount you want to change.

- Choose a way to get paid: Next, pick a place for the fiat to go. If your provider is available in your area, you may be able to send it to a bank account, PayPal, or another way.

- When you compare offers, MetaMask brings together deals from a number of outside service providers, such as MoonPay, Transak, Sardine, and more. It then displays the exchange rates, fees, and expected refund times in real time. Look at each one and choose the best one for you.

- Finish the deal: Once you’ve picked a service provider, MetaMask will show you how to send the cryptocurrency. The transaction will be confirmed in your wallet, and the money will be sent to the provider, who will pay you in cash.

When you use the MetaMask app, there are two things you should remember:

- To begin, the third-party companies will ask for KYC, even if the app itself doesn’t. Get your papers ready for this one.

- Second, MetaMask’s sell function only works with Ethereum on the mainnet. As was already said, this is where the bridge will come in.

Getting crypto out of centralized markets

This is a popular choice if you’d rather cash out your crypto through a controlled exchange. It’s easy for beginners to use, lets you take cash, and works with many different assets. Note that you will need to finish Know Your Customer (KYC) verification before you can withdraw any fiat.

Step by step, here’s how to do it:

- Send money to Coinbase from MetaMask

To begin, you will need to move your money from MetaMask to Coinbase.

- To send and receive money, go to the top of your Coinbase account and click “Send & Receive.”

- You can send ETH or USDC, and Coinbase will give you a wallet address. Click on the “Receive” tab and copy that address.

- Watch out for the right network. For instance, if you’re sending ETH, it should be on the Ethereum (ERC-20) network.

Open up MetaMask now:

- Type in the Coinbase address, click “Send,” and then type in the amount you want to send.

- Make sure you send it to the right network. If you send it to the wrong one, your money could disappear.

- As soon as you click “Confirm,” your cryptocurrency should appear in Coinbase.

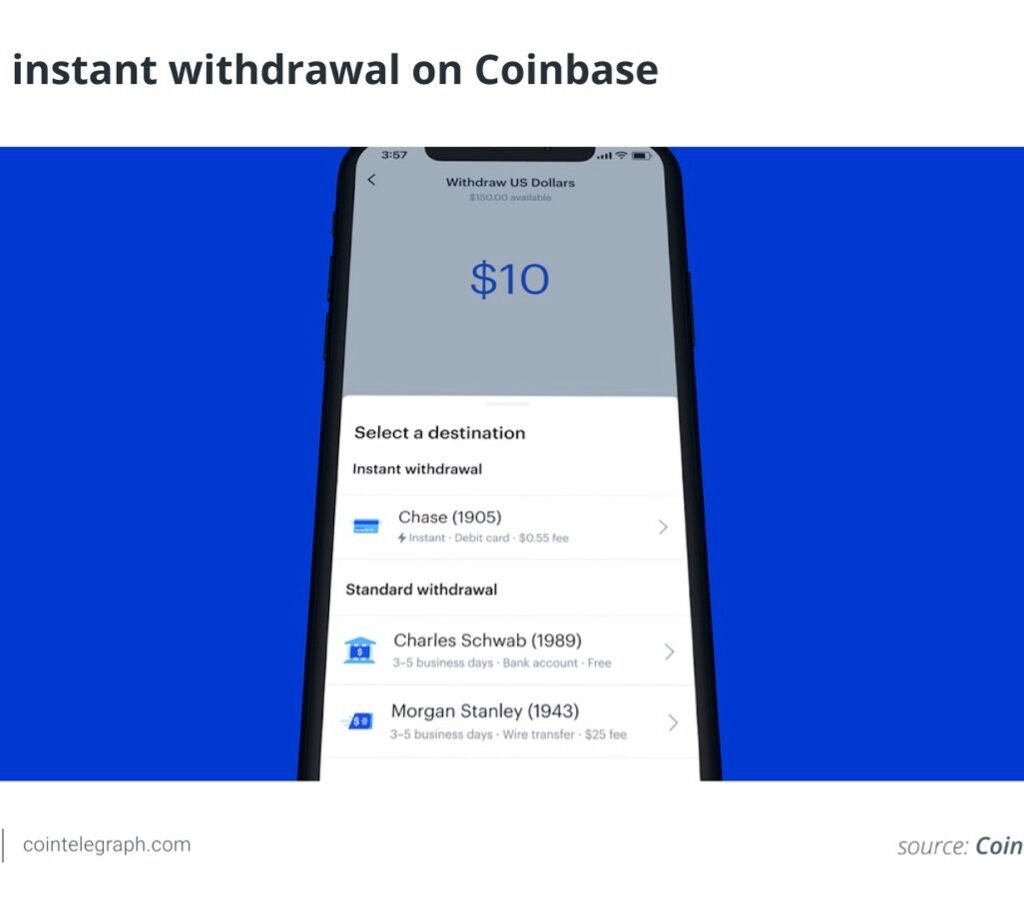

- Use Coinbase to trade crypto for cash.

As soon as your money reaches Coinbase, you can cash it out.

- Go to the top and click on “Buy & Sell.” Then, click on the “Sell” tab.

- Select the cryptocurrency you just got and choose how much you wish to sell it for.

- That’s up to you. You can send the money to a linked bank account, PayPal, or your Coinbase amount.

- Look over everything, including any fees, and then click “Sell.”

Did you know? When withdrawing via centralized exchanges, be cautious of minimum withdrawal amounts and any associated fees. Check these details in advance to make sure the limits and costs are acceptable to you before committing to this route.

Peer-to-peer with Know Your Customer

You don’t sell your cryptocurrency to an exchange when you use peer-to-peer (P2P). You’re selling it to someone else instead. Pick a buyer based on what they offer and how they’d like to pay, such as bank transfer, Revolut, Wise, etc. You give them the crypto once they send the money to your account. Your crypto is kept safe by the site during the process, so no one can just walk away with your money.

You’ll need to finish Know Your Customer (KYC) steps before you can trade in this way on centralized exchanges.

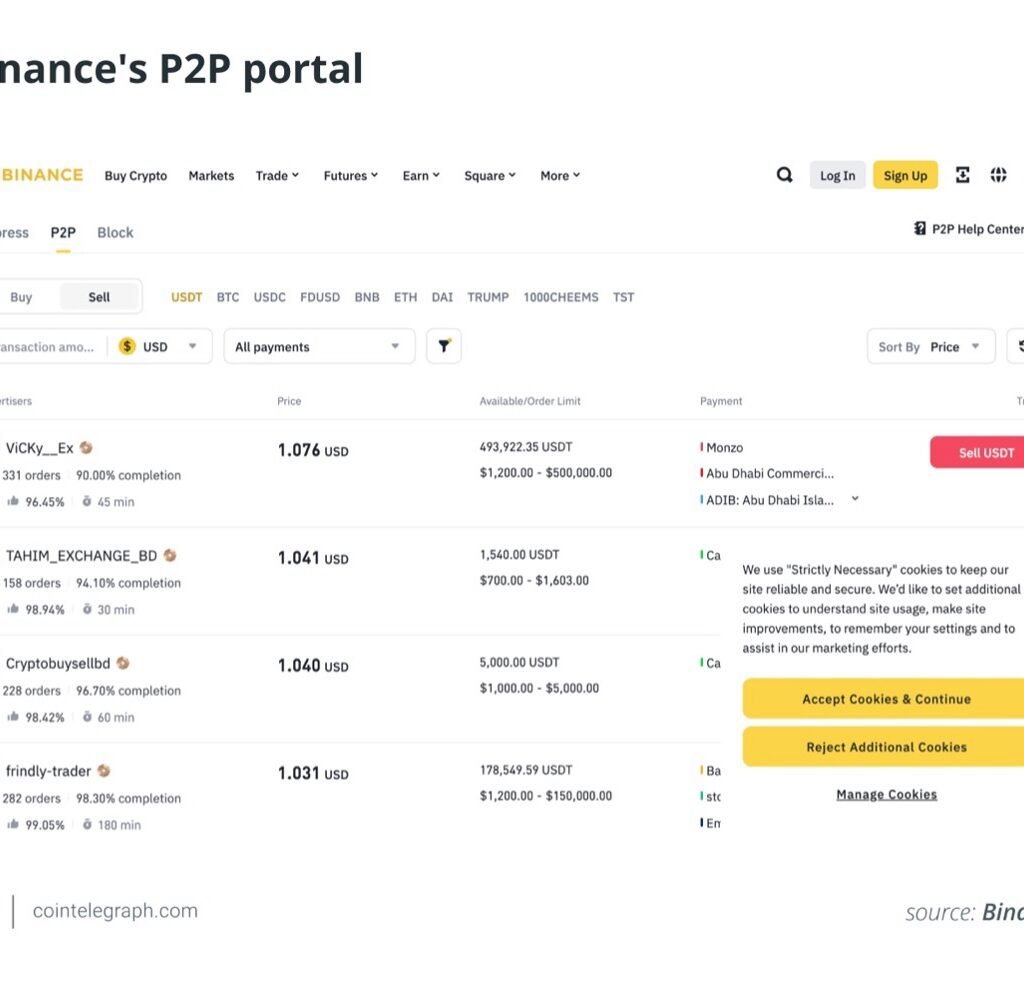

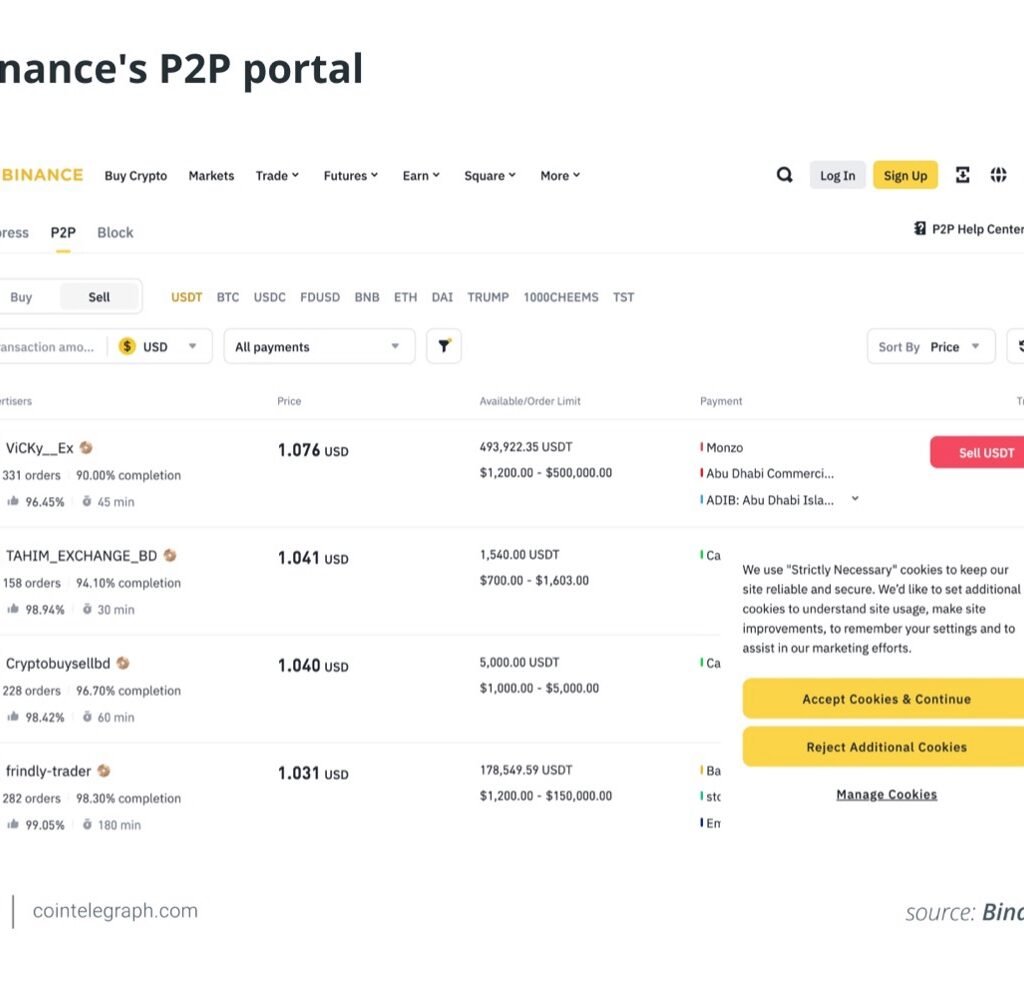

Binance users can sell through P2P.

Click on Trade and then P2P.

- Pick the coin you want to sell and look through the list of people who want to buy it.

- Pick a deal, confirm the order, and then wait for the buyer to pay.

- As soon as the payment hits your account, confirm it and take the cryptocurrency out of lockup.

Did you know? Some peer-to-peer (P2P) cryptocurrency exchanges offer a “cash by mail” option, allowing users to send physical cash through postal services or couriers to settle transactions.

Taking money out of your MetaMask wallet without proving who you are

There are still a few good ways for MetaMask wallet users to change cryptocurrency to fiat cash without going through Know Your Customer (KYC) verification.

Like controlled P2P platforms, decentralized ones let you trade directly with other users, but often with few or no Know Your Customer (KYC) requirements.

- LocalCoinSwap is a peer-to-peer market that doesn’t hold your money and accepts a lot of different cryptocurrencies and payment ways, such as cash. It protects you with a trust account and puts privacy first.

- Bisq is a fully decentralized market that works with many cryptocurrencies, such as Bitcoin and Monero (XMR) ($255.92). It doesn’t need user accounts or Know Your Customer (KYC) and works on a peer-to-peer system.

Without KYC, on the other hand, you have to check out the person you’re dealing with. Check their reputation and any trade history that is visible. Also, always follow the safety rules for the platform.

Taking crypto out of MetaMask using bitcoin ATMs

You can turn your digital assets into cash by using cryptocurrency ATMs, which are also known as Bitcoin ATMs, to withdraw money from your MetaMask bank. This method can be used in this way:

- Find a cryptocurrency ATM: To start, look for a cryptocurrency ATM nearby. Websites like CoinATMRadar list Bitcoin ATM spots around the world along with the cryptocurrencies they accept and the services they provide.

- Get your MetaMask wallet ready. Make sure the ATM accepts the coin you want to withdraw. Most Bitcoin ATMs only accept Bitcoin (BTC) worth $118,845 USD, so you might need to use a decentralized exchange (DEX) to convert your present tokens to BTC in your MetaMask wallet. During this process, keep in mind the transaction fees and exchange rates.

- Start the process of withdrawal: Pick the choice to get cash from the ATM. The machine will ask you how much money you want to take out and give you a QR code that shows the ATM’s wallet address.

- To send money from MetaMask, use your MetaMask wallet to scan the ATM’s QR code and enter the correct receiver address. Type in the exact amount of cryptocurrency that you want to send and then confirm the exchange. Keep in mind that a busy network can slow down processing times.

- Get your cash. Once the blockchain confirms the transaction, the ATM will give you the same amount of money in cash, minus any fees that may have been charged. Depending on how the network is set up, this process could take a few minutes or longer.

You can expect to pay a lot of money to use crypto ATMs. Also, small transfers usually don’t need KYC, but bigger ones might.

Do MetaMask crypto transfers get taxed?

Taxes aren’t the most interesting subject, but they do matter when you exchange crypto from your MetaMask wallet for cash. If you sell crypto through MetaMask, an exchange, or a peer-to-peer deal, you may be subject to taxes. It is important to know the rules that apply.

When you sell crypto, you might be taxed.

Selling crypto for cash (like US dollars, euros, etc.) is the same as selling real estate in most countries, including the US. If you bought ETH for $1,000 and then sold it for $1,500, you made a $500 capital gain, which is normally taxed.

If you trade one cryptocurrency for another, like ETH for USDC, you may still have to pay taxes on that exchange, even if no traditional currency is involved. You don’t have to cash out to report a trade; any trade counts.

To keep track of it, write down:

- The dates you bought and sold each item

- How much you bought or sold

- How much money it was worth at the time

- Any fees that were paid along the way.

You’ll have a lot less stress when it’s tax time or when your bookkeeper gives you that look.

Know the rules in your area.

There are different crypto rules for each country. There are different rules for each country, and even within the same country, the rules can change based on how you use crypto.

There may be capital gains tax rules or even money transmission laws in the US when you sell crypto, based on how the money is moved. There may be rules that are much less strict or much tighter in other countries.

Now, here’s what you should do:

- Find out what the crypto tax rules are in your area, even if they seem unclear or out of date.

- Keep up with the rules; they change quickly.

- If you’re not sure, ask a pro. A lawyer or accountant who knows a lot about crypto can help you avoid bad shocks.

The tax office may still want a full report even if you’re not using Know Your Customer (KYC) ways or decentralized tools. It will save you trouble in the long run, and it could even save you money.

Have fun paying out!